Get the free wfcm form borrower authorization

Show details

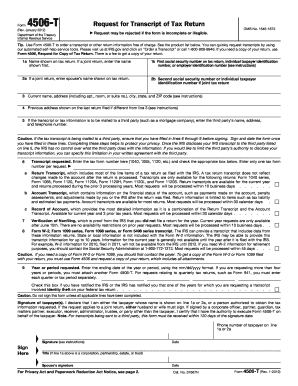

Wells Fargo Commercial Mortgage Servicing BORROWER AUTHORIZATION FORM Loan Number Date Borrower Name The undersigned, authorized representative of the Borrower, authorizes any one of the individuals

pdfFiller is not affiliated with any government organization

Get, Create, Make and Sign

Edit your wfcm form borrower authorization form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your wfcm form borrower authorization form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit wfcm form borrower authorization online

Follow the guidelines below to use a professional PDF editor:

1

Check your account. In case you're new, it's time to start your free trial.

2

Upload a document. Select Add New on your Dashboard and transfer a file into the system in one of the following ways: by uploading it from your device or importing from the cloud, web, or internal mail. Then, click Start editing.

3

Edit wfcm form borrower authorization pdf. Rearrange and rotate pages, add new and changed texts, add new objects, and use other useful tools. When you're done, click Done. You can use the Documents tab to merge, split, lock, or unlock your files.

4

Save your file. Select it from your list of records. Then, move your cursor to the right toolbar and choose one of the exporting options. You can save it in multiple formats, download it as a PDF, send it by email, or store it in the cloud, among other things.

pdfFiller makes working with documents easier than you could ever imagine. Register for an account and see for yourself!

How to fill out wfcm form borrower authorization

How to fill out wells fargo borrower certification:

01

Obtain the wells fargo borrower certification form from the Wells Fargo website or a local branch.

02

Carefully review the instructions and requirements stated on the form.

03

Fill in your personal information accurately, including your name, address, contact information, and social security number.

04

Provide the necessary details about your loan, such as the loan number, property address, and loan purpose.

05

Read the borrower certification statements carefully and sign the form to acknowledge your understanding and agreement.

06

If required, have a witness sign the form to verify your signature.

07

Double-check all the information provided to ensure its accuracy and legibility.

08

Keep a copy of the completed borrower certification form for your records.

Who needs wells fargo borrower certification:

01

Individuals who have obtained a loan from Wells Fargo.

02

Borrowers who need to certify certain information about their loan.

03

Customers who have been instructed or requested by Wells Fargo to fill out the borrower certification form.

Video instructions and help with filling out and completing wfcm form borrower authorization

Instructions and Help about borrower authorization fillable form

Fill fillable borrower's authorization form : Try Risk Free

Our user reviews speak for themselves

Read more or give pdfFiller a try to experience the benefits for yourself

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is wells fargo borrower certification?

Wells Fargo borrower certification is a document that a borrower is required to complete and provide to Wells Fargo, a banking and financial services company, to verify their information and certify certain details regarding their loan application or borrowing arrangement. This certification typically includes details such as the borrower's identity, employment status, income, liabilities, and other relevant information. The purpose of the borrower certification is to ensure that the borrower has provided accurate and truthful information to the lender.

Who is required to file wells fargo borrower certification?

The Wells Fargo Borrower Certification is typically required to be filed by borrowers who are applying for a loan or credit from Wells Fargo. This certification is a document that verifies the borrower's financial information and acknowledges their responsibility for the loan or credit.

How to fill out wells fargo borrower certification?

To fill out the Wells Fargo Borrower Certification, follow these steps:

1. Download the form: Visit the Wells Fargo website or contact your loan officer to obtain a copy of the Borrower Certification form.

2. Review the form: Read through the form fully to understand what information is required and what certifications you will need to make.

3. Personal information: Fill in your personal information such as your name, address, phone number, and social security number. This information is generally found at the top of the form.

4. Loan information: Provide details about the loan you are applying for or have received, including the loan number, loan amount, and loan purpose.

5. Certification statements: Carefully read each certification statement and check the appropriate box to indicate your agreement or certification. Be sure to review each statement thoroughly to ensure you understand what you are certifying.

6. Signature: Sign and date the form at the bottom to certify that all the information provided is accurate to the best of your knowledge.

7. Submit the form: Send the completed form to the appropriate party, such as your loan officer or the Wells Fargo loan processing department. Follow any specific instructions provided by Wells Fargo for submitting the form.

Note: It is important to fill out the form accurately and honestly. Providing false information or making false certifications on the form can have serious consequences.

What is the purpose of wells fargo borrower certification?

The purpose of Wells Fargo borrower certification is to verify certain information provided by the borrower in a loan application. It is a document that the borrower signs to certify the accuracy and completeness of the information provided, as well as to acknowledge their understanding of the terms and conditions of the loan. The certification is typically required by Wells Fargo as part of their loan approval process to ensure that borrowers are providing truthful and accurate information.

What information must be reported on wells fargo borrower certification?

The specific information required to be reported on a Wells Fargo borrower certification may vary depending on the context and purpose of the certification. However, some common elements that may need to be included are:

1. Borrower's name: The full legal name of the borrower.

2. Loan details: Information about the specific loan, such as the loan number, loan type (e.g., mortgage, personal loan), loan amount, and interest rate.

3. Borrower's contact information: Include the borrower's address, phone number, and email address.

4. Income information: Details about the borrower's income, including employment status, employer name and contact information, monthly income amount, and any other sources of income (e.g., investments, child support).

5. Financial statements: The borrower may need to provide details about their assets, liabilities, and other financial obligations.

6. Certification statements: The borrower may need to certify that the provided information is true and accurate, and that they understand the terms and conditions of the loan.

7. Other supporting documents: The certification may require the borrower to attach additional documents, such as proof of income (e.g., pay stubs, tax returns) or identification documents.

It is important to note that the above information is general in nature and may not cover all potential requirements. The specific details and documentation required on a Wells Fargo borrower certification can be obtained from Wells Fargo directly or by consulting the loan agreement or application materials.

How can I modify wfcm form borrower authorization without leaving Google Drive?

By combining pdfFiller with Google Docs, you can generate fillable forms directly in Google Drive. No need to leave Google Drive to make edits or sign documents, including wfcm form borrower authorization pdf. Use pdfFiller's features in Google Drive to handle documents on any internet-connected device.

How do I complete loan submission summary wells fargo online?

pdfFiller makes it easy to finish and sign executive president online. It lets you make changes to original PDF content, highlight, black out, erase, and write text anywhere on a page, legally eSign your form, and more, all from one place. Create a free account and use the web to keep track of professional documents.

Can I create an eSignature for the borrower's authorization form in Gmail?

You may quickly make your eSignature using pdfFiller and then eSign your wfcm borrower authorization print form right from your mailbox using pdfFiller's Gmail add-on. Please keep in mind that in order to preserve your signatures and signed papers, you must first create an account.

Fill out your wfcm form borrower authorization online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Loan Submission Summary Wells Fargo is not the form you're looking for?Search for another form here.

Keywords relevant to wells fargo seller guide form

Related to wells fargo funding seller guide

If you believe that this page should be taken down, please follow our DMCA take down process

here

.